Tax Refunds made easy

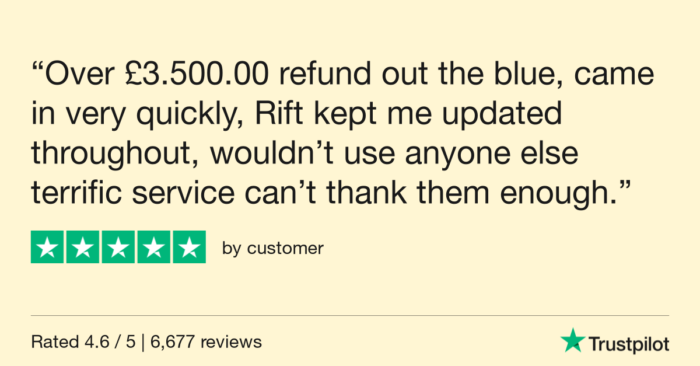

On average RIFT get customers a £3,000 tax refund for travel related work expenses. Fill in the form and use a tax expert to calculate it all.

Find out what you’re owed

Who We Help

Construction & Trades

From ground-workers to plumbers, UK construction workers, both CIS & PAYE are eligible to claim through RIFT Tax Refunds..

Armed Forces

Serving and former military personnel can claim for travel expenses for postings and training assignments of under 24 months.

Security

From work mileage and SIA license fees to the upkeep of your uniform, claim it back through our partners.

Offshore

Offshore workers can claim a tax refund for travel to “temporary workplaces” including travel to and from airports or heliports.

How It Works

Contact a RIFT Expert

Get in touch with one of RIFT’s experts to guide you through the process..

Calculate your claim

Skip the faff. Let the best in the business handle the sums and stay stress-free.

Receive your refund

Skip the faff. Let the best in the business handle the sums and stay stress-free.

You Can Claim For

- Travel expenses

- Cost of specialist clothing and uniforms

- Accommodation costs on the road

- Paying too much self assessment tax

- Tools and specialist equipment

What it costs

Our standard charges are:

- Tax refund if you’re employed under PAYE: 30% of refund claimed + VAT (minimum fee £50 +VAT)

- CIS Tax Refund including tax return £275+VAT

It costs nothing to find out if you have a claim.

As with most goods and services, we’re required by law to charge VAT at 20%. VAT is applied to our fee only, not to your whole refund, and it’s paid to HMRC.